Realized Garch model with dynamical conditional correlation

The accompanying report is here

The package rGARCH_DCC is included here and it is priliminary and hopefully I can make it user friendly and will publish to my github.

Realized GARCH-DCC Model

In this project we will study the realized GARCH-DCC model. This model is designed to do forecast of volatility and correlation among symbols. The model takes into high frequency data.

Specifically, we let $r^i_t$ to denote the log return $\log P^i_t - \log P^i_{t-1}$ for stock $i$, $\sigma^i_t$ to be the conditional variance of stock $i$, $z_t^i$ to be the shock for stock $i$ and $C_t$ be the conditional correlation matrix among $z_t^i$. The model can be described as

\[\begin{aligned} &r_t^i = \mu^i + \sigma_t^i z_t^i \\ &\log(\text{RV}_t^i) = \xi^i + \phi^i \log(\sigma_{t}^i)^2 + \tau^i_1 z_t^i + \tau^i_2 ((z_t^i)^2-1) + u_t^i\\ &(\sigma_{t+1}^i)^2 = \omega^i + \beta^i (\sigma_{t}^i)^2 + \gamma^i \text{RV}_t^i \\ &C_t = \text{diag}(Q_t)^{-1/2} Q_t \text{diag}(Q_t)^{-1/2} \label{eq:section2:normalization} \\ &Q_{t+1} = S(1-a-b) + a (z_t z_t^T) + bQ_t \label{eq:section2:covariance} \\ &z_t \sim \mathcal{N}(0, C_t) \\ &u_t \sim \mathcal{N}(0, \Sigma_u) . \end{aligned}\]The first equation describes the return using the volatility scale and the constant expected mean $\mu^i$. The second equation describes the “measurement” mechanics: the realized variance depends on the hidden true volatility and the shocks as well as a measurement noise $u_t$. These $u_t$ have zero pairwise correlation but have different scales for different stock $i$ and thus $\Sigma_u$ is a diagonal matrix. The log transformation on the measurement equation is to make the noise $u_t$ similar to Normal distribution. The third equation is the updating equation for the volatility $\sigma_t^i$. Notice, the usual GARCH model uses return squared to update the volatility but here, we use the more accurate estimate, the realized variance. The $Q_{t}$ is the sample estimate of the conditional covariance matrix of $z_t$ and the update equation is mean revert to the sample estimation $S$. The normalization ensures that the covariance matrix for the shocks is normalized.

import numpy as np

import pandas as pd

import pandas_market_calendars as mcal

import datetime

from scipy.optimize import minimize

from sklearn.linear_model import LinearRegression

from arch import arch_model

import matplotlib.pyplot as plt

from matplotlib.ticker import MaxNLocator

import matplotlib.dates as mdates

from matplotlib.ticker import FormatStrFormatter

from statsmodels.graphics.gofplots import qqplot

import matplotlib

from rGARCH_DCC import *

font = { "family": "sans",

"weight": "normal",

'size' : 12}

matplotlib.rc('font', **font)

Load Data

We first load data from https://firstratedata.com/free-intraday-data. The data contains AAPL, AMZN, FB, MSFT, TSLA and SP500 one minute tick data in 2019.

FOLDER = "/Users/bunny_home/Documents/Cunwei/stockData/"

AAPL_FILE = FOLDER + "AAPL_FirstRateDatacom1.txt"

AMZN_FILE = FOLDER + "AMZN_FirstRateDatacom1.txt"

FB_FILE = FOLDER + "FB_FirstRateDatacom1.txt"

MSFT_FILE = FOLDER + "MSFT_FirstRateDatacom1.txt"

TSLA_FILE = FOLDER + "TSLA_FirstRateDatacom1.txt"

SPX_FILE = FOLDER + "SPX_Firstratedata1.txt"

FILES = {"AAPL" : AAPL_FILE,

"AMZN" : AMZN_FILE,

"FB" : FB_FILE,

"MSFT" : MSFT_FILE,

"TSLA" : TSLA_FILE,

"SP500": SPX_FILE}

Since there are missing ticks in the data, we then construct time ticks frame in one minute frequency and left join with the data. This ensures the data all in one tick frequency and can be joined conveniently.

def get_trading_index(start, end):

nyse = mcal.get_calendar('NYSE')

days = nyse.valid_days(start_date = start, end_date = end)

date_index = []

for d in days:

#print (d)

early_close = [datetime.date(d.year, 7,3),

datetime.date(d.year, 11,29),

datetime.date(d.year, 12,24)]

if d.date() in early_close :

open_time = pd.Timestamp(year=d.year, month = d.month,

day = d.day, hour = 9, minute = 30)

close_time = pd.Timestamp(year=d.year, month = d.month,

day = d.day, hour = 13, minute = 0)

else:

schedule = nyse.schedule(start_date = d.date(), end_date = d.date(), tz = nyse.tz.zone)

open_time = schedule["market_open"][0].replace(tzinfo=None)

close_time = schedule["market_close"][0].replace(tzinfo=None)

date_index += pd.date_range(open_time, close_time, freq = "1T")

return pd.Series(date_index)

def load_file(filename, trading_index):

df = pd.read_csv(filename, header=None)

df.columns = ["time", "open", "high", "low", "close", "volume"][:len(df.columns)]

df["time"] = pd.to_datetime(df["time"], format= "%Y-%m-%d %H:%M:%S")

df = df.set_index("time")

dummy = pd.DataFrame.from_dict({"time":trading_index,

"dummy": np.ones(len(trading_index)) } )

dummy = dummy.set_index("time")

df = dummy.join(df)

df = df.drop("dummy", axis = 1)

return df

DATA = {}

print ("Generating time ticks ...")

TRADING_MINUTES = get_trading_index("2019-01-01", "2019-12-30")

print ("Ticks number: %d" % (len(TRADING_MINUTES)))

for F in FILES:

data = load_file(FILES[F], TRADING_MINUTES)

DATA[F] = data

print ("%s\t length: %d, done" %(F, data.shape[0]))

Generating time ticks ...

Ticks number: 97601

AAPL length: 97601, done

AMZN length: 97601, done

FB length: 97601, done

MSFT length: 97601, done

TSLA length: 97601, done

SP500 length: 97601, done

combine = []

keys = []

for s in DATA:

combine.append(DATA[s]["close"])

keys.append(s)

prices = pd.concat(combine, axis = 1, keys = keys)

prices

| AAPL | AMZN | FB | MSFT | TSLA | SP500 | |

|---|---|---|---|---|---|---|

| time | ||||||

| 2019-01-02 09:30:00 | 154.7800 | 1466.9690 | 129.7950 | 99.010 | 305.9600 | 2470.40 |

| 2019-01-02 09:31:00 | 155.1597 | 1469.0000 | 130.1100 | 99.250 | 308.8050 | 2470.80 |

| 2019-01-02 09:32:00 | 154.8073 | 1470.6300 | 130.4329 | 99.220 | 306.9370 | 2471.26 |

| 2019-01-02 09:33:00 | 154.6700 | 1470.8000 | 130.4700 | 99.355 | 305.1100 | 2469.64 |

| 2019-01-02 09:34:00 | 154.7500 | 1473.9806 | 130.6524 | 99.410 | 303.8800 | 2470.11 |

| ... | ... | ... | ... | ... | ... | ... |

| 2019-12-30 15:56:00 | 291.4700 | 1846.7900 | 204.4700 | 157.585 | 414.6150 | 3220.75 |

| 2019-12-30 15:57:00 | 291.4477 | 1845.5500 | 204.4200 | 157.520 | 414.4712 | 3219.83 |

| 2019-12-30 15:58:00 | 291.3800 | 1845.5100 | 204.3000 | 157.410 | 414.3600 | 3218.84 |

| 2019-12-30 15:59:00 | 291.6470 | 1847.1800 | 204.4100 | 157.680 | 414.6200 | 3222.06 |

| 2019-12-30 16:00:00 | 291.6100 | 1846.8900 | 204.3600 | 157.590 | 414.4700 | NaN |

97601 rows × 6 columns

Clean Nans and Create Log Returns

Since some data are missing for specific ticks and we should clean them. From the nan counts, we see that most of the nans are in 2019-09-30 and since each day should contain 391 points from 9:30am to 4:00pm inclusive, this means the data are all missing in 2019-09-30. We just drop that day.

def get_Nan_days(data):

nans = data.isna()

nans = nans.groupby(nans.index.date).sum()

return nans.loc[(nans > 1).sum(axis = 1)>1]

nan_days = get_Nan_days(prices)

nan_days

| AAPL | AMZN | FB | MSFT | TSLA | SP500 | |

|---|---|---|---|---|---|---|

| 2019-08-28 | 0 | 3 | 0 | 0 | 2 | 1 |

| 2019-09-30 | 0 | 391 | 391 | 391 | 391 | 1 |

| 2019-10-17 | 2 | 2 | 0 | 0 | 0 | 1 |

| 2019-10-21 | 4 | 10 | 4 | 4 | 4 | 1 |

delete_idx = (prices.index.date==datetime.date(2019,9,30))

prices = prices.loc[~delete_idx]

prices = prices.fillna(method="ffill")

get_Nan_days(prices)

| AAPL | AMZN | FB | MSFT | TSLA | SP500 |

|---|

prices.shape

(97210, 6)

we then just construct the log returns in one minute frequency.

# The log return:

returns = np.log(prices).groupby(prices.index.date).diff()

returns

| AAPL | AMZN | FB | MSFT | TSLA | SP500 | |

|---|---|---|---|---|---|---|

| time | ||||||

| 2019-01-02 09:30:00 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2019-01-02 09:31:00 | 0.002450 | 0.001384 | 0.002424 | 0.002421 | 0.009256 | 0.000162 |

| 2019-01-02 09:32:00 | -0.002274 | 0.001109 | 0.002479 | -0.000302 | -0.006067 | 0.000186 |

| 2019-01-02 09:33:00 | -0.000887 | 0.000116 | 0.000284 | 0.001360 | -0.005970 | -0.000656 |

| 2019-01-02 09:34:00 | 0.000517 | 0.002160 | 0.001397 | 0.000553 | -0.004039 | 0.000190 |

| ... | ... | ... | ... | ... | ... | ... |

| 2019-12-30 15:56:00 | 0.000103 | 0.000846 | 0.000489 | 0.000667 | 0.000084 | 0.000096 |

| 2019-12-30 15:57:00 | -0.000077 | -0.000672 | -0.000245 | -0.000413 | -0.000347 | -0.000286 |

| 2019-12-30 15:58:00 | -0.000232 | -0.000022 | -0.000587 | -0.000699 | -0.000268 | -0.000308 |

| 2019-12-30 15:59:00 | 0.000916 | 0.000904 | 0.000538 | 0.001714 | 0.000627 | 0.001000 |

| 2019-12-30 16:00:00 | -0.000127 | -0.000157 | -0.000245 | -0.000571 | -0.000362 | 0.000000 |

97210 rows × 6 columns

returns = returns.dropna()

returns.to_csv("logReturns.csv")

Test Train split

test_index = returns.index.date >= datetime.date(2019,12,1)

train = returns[~test_index]

test = returns[test_index]

Construct Realized Variance

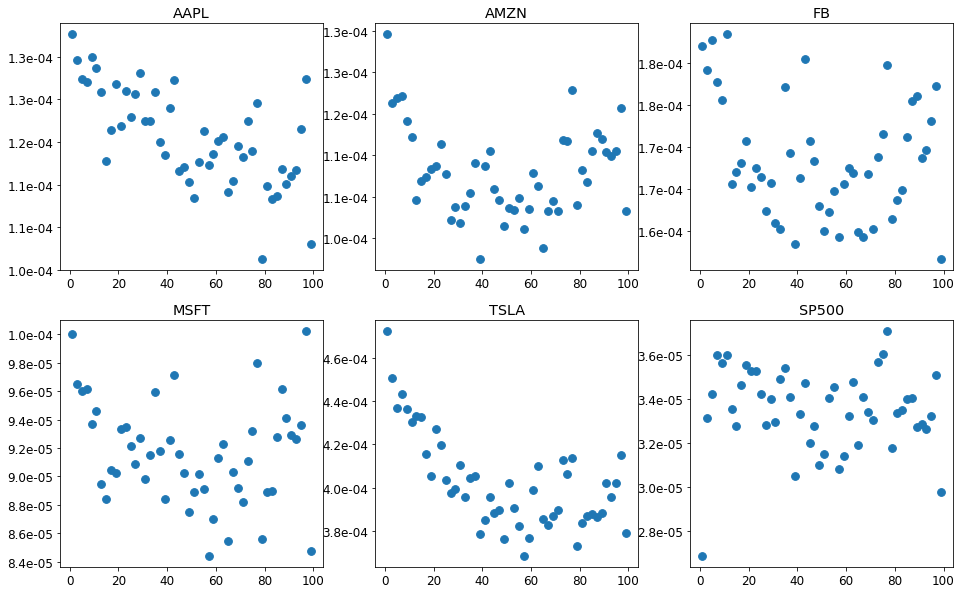

In calculating the realized variance, the frequency of data points need to be chosen. Since our data is spaced in one minute frequence, we should choose intervals larger than that. We calculate realized Variance for different spacing and plot the realized variance vs the spacing. Then we would choose the spacing corresponding to the minimum value as the optimal spacing.

def RV_singleDay(returns, spacing):

res = 0

for start_tick in range(spacing):

res += RV_singleDay_test(returns, spacing, start_tick)

return res/spacing

def RV_singleDay_test(returns, spacing, start_tick):

sums = returns.rolling(spacing).sum()

if len(sums.shape) == 1:

return np.sum((sums.iloc[start_tick+spacing::spacing])**2, axis = 0)

return np.sum((sums.iloc[start_tick+spacing::spacing,:])**2, axis = 0)

def getRVs(returns, spacing, start_idx = None):

def RVsingle(x):

return RV_singleDay(x, spacing)

if start_idx is None:

return returns.groupby(returns.index.date).apply(RVsingle)

def RVsingle_test(x):

return RV_singleDay_test(x, spacing, start_idx)

return returns.groupby(returns.index.date).apply(RVsingle_test)

def multipleRVs(returns, spacing):

res = {}

for s in returns.columns:

res[s] = getRVs(returns[s], spacing[s])

res = pd.DataFrame.from_dict(res, orient = "columns")

return res

def test_spacing(data, max_spacing, step = 1, start_idx = None):

res = {}

for s in range(1,max_spacing+1, step):

res[s] = getRVs(train, s, start_idx).mean(axis = 0)

res = pd.DataFrame.from_dict(res, orient = "index")

res["spacing"] = res.index

return res

RV_tuning = test_spacing(train, 100, start_idx = 0, step=2)

fig, axs = plt.subplots(2, 3, figsize=(16,10))

for i in range(2):

for j in range(3):

ax = axs[i][j]

ax.scatter(RV_tuning.iloc[:,-1], RV_tuning.iloc[:,i*3+j], s = 60)

#ax.set_yscale("log")

ax.yaxis.set_major_formatter(FormatStrFormatter('%1.1e'))

ax.title.set_text(RV_tuning.columns[i*3+j])

plt.savefig("RVspacing.png")

plt.show()

From the above plot, we choose the smallest minute after which the realized variance stablize and this corresponds to the values listed below and we can trasnform the data to get daily realized variance.

SPACING = {

"AAPL" : 40,

"AMZN" : 30,

"FB" : 10,

"MSFT" : 10,

"TSLA" : 40,

"SP500": 10

}

def collapse_daily(returns, spacing=SPACING):

RVs = multipleRVs(returns, spacing)

returns = returns.groupby(returns.index.date).sum()

index = pd.MultiIndex.from_product([returns.columns, ["RV", "return"] ] )

data = pd.DataFrame(np.zeros((RVs.shape[0], RVs.shape[1]*2)),

index = RVs.index, columns = index)

for j in RVs.columns:

data.loc[:, (j,"return")] = returns[j]

data.loc[:, (j, "RV")] = RVs[j]

return data

train_daily = collapse_daily(train)

test_daily = collapse_daily(test)

index = (train_daily["TSLA"]["RV"] == 0)

train_daily = train_daily[~index]

train_daily

| AAPL | AMZN | FB | MSFT | TSLA | SP500 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| RV | return | RV | return | RV | return | RV | return | RV | return | RV | return | |

| 2019-01-02 | 0.000276 | 0.018817 | 0.000566 | 0.047986 | 0.000478 | 0.044343 | 0.000252 | 0.021878 | 0.000517 | 0.012795 | 0.000143 | 0.014631 |

| 2019-01-03 | 0.000334 | -0.014916 | 0.000346 | -0.017998 | 0.000446 | -0.021329 | 0.000419 | -0.025744 | 0.000573 | -0.024370 | 0.000222 | -0.019205 |

| 2019-01-04 | 0.000240 | 0.025416 | 0.000369 | 0.031095 | 0.000224 | 0.023634 | 0.000381 | 0.025587 | 0.000389 | 0.032885 | 0.000171 | 0.022167 |

| 2019-01-07 | 0.000355 | -0.002600 | 0.000272 | 0.019787 | 0.000296 | 0.001024 | 0.000194 | 0.005699 | 0.000679 | 0.040694 | 0.000068 | 0.006271 |

| 2019-01-08 | 0.000114 | 0.007528 | 0.000419 | -0.002183 | 0.000299 | 0.012709 | 0.000191 | -0.003128 | 0.001019 | -0.021433 | 0.000087 | 0.001863 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2019-11-22 | 0.000038 | -0.002365 | 0.000027 | 0.004836 | 0.000064 | -0.000905 | 0.000034 | -0.003204 | 0.000223 | -0.020516 | 0.000007 | -0.000595 |

| 2019-11-25 | 0.000022 | 0.012085 | 0.000052 | 0.008161 | 0.000050 | 0.000200 | 0.000012 | 0.006900 | 0.000164 | -0.014727 | 0.000004 | 0.003998 |

| 2019-11-26 | 0.000012 | -0.006490 | 0.000035 | 0.009007 | 0.000034 | -0.004639 | 0.000016 | 0.003198 | 0.000120 | -0.016852 | 0.000006 | 0.002352 |

| 2019-11-27 | 0.000011 | 0.008658 | 0.000036 | 0.011019 | 0.000085 | 0.011351 | 0.000013 | 0.000722 | 0.000083 | 0.004661 | 0.000002 | 0.002683 |

| 2019-11-29 | 0.000007 | 0.001948 | 0.000030 | -0.010237 | 0.000081 | 0.001410 | 0.000015 | -0.004232 | 0.000027 | -0.000545 | 0.000003 | -0.001396 |

229 rows × 12 columns

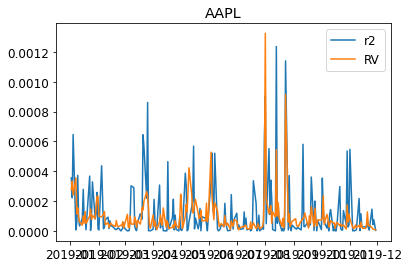

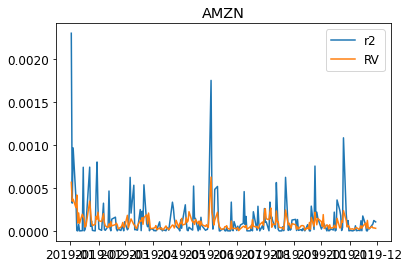

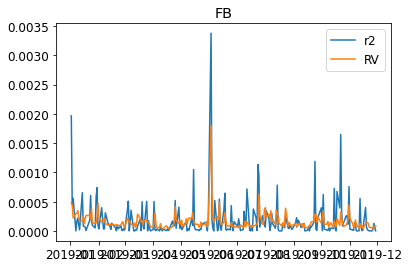

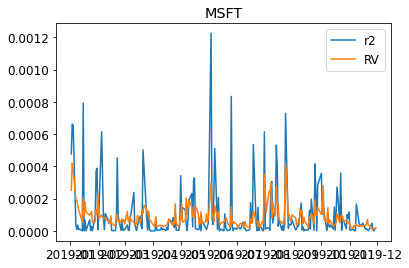

We can visualize the realized variance and the squared log returns.

for s in DATA:

plt.figure()

plt.title(s)

plt.plot((train_daily[s]["return"]**2),label="r2")

plt.plot(train_daily[s]["RV"],label="RV")

plt.legend(loc = "best")

plt.show()

We then fit the individual realized Garch

GARCHs = {}

PARAMs = {}

scale = 1e3

for symbol in DATA:

print ("fit symbol "+ str(symbol) + " ...")

returns = train_daily[symbol]["return"]

RVs = train_daily[symbol]["RV"]

rl_garch = RealizedGARCH(returns, RVs, scale = scale)

rl_garch.fit(verbose = 0)

GARCHs[symbol] = rl_garch

params = pd.concat( (rl_garch.params, rl_garch.measure_params) )

PARAMs[symbol] = params

PARAMs = pd.DataFrame.from_dict(PARAMs, orient="columns")

PARAMs

fit symbol AAPL ...

best L1 = -650.558

fit symbol AMZN ...

best L1 = -668.673

fit symbol FB ...

best L1 = -711.490

fit symbol MSFT ...

best L1 = -636.488

fit symbol TSLA ...

best L1 = -816.116

fit symbol SP500 ...

best L1 = -498.618

| AAPL | AMZN | FB | MSFT | TSLA | SP500 | |

|---|---|---|---|---|---|---|

| omega | 0.000035 | 0.000013 | 0.000012 | 0.000011 | 0.000241 | 0.000003 |

| beta | 0.306265 | 0.804552 | 0.932296 | 0.665771 | 0.000000 | 0.415299 |

| gamma | 0.498232 | 0.112582 | 0.000000 | 0.248973 | 0.762372 | 0.502016 |

| mu | 0.001039 | 0.000049 | 0.000246 | 0.000175 | 0.000450 | 0.000387 |

| xi | 0.221838 | 7.076395 | 153.648558 | 2.076153 | -1.130535 | -0.787398 |

| phi | 1.084924 | 1.846474 | 18.791195 | 1.256567 | 0.931592 | 0.943701 |

| tau1 | -0.101627 | -0.092318 | -0.105260 | -0.072026 | -0.026562 | -0.174259 |

| tau2 | 0.244832 | 0.176118 | 0.134127 | 0.156663 | 0.149789 | 0.153689 |

| sigmaU | 0.650246 | 0.584097 | 0.490212 | 0.444128 | 0.566098 | 0.554517 |

def realizedGarch_log_likelihood():

Likelihoods = {}

for symbol in GARCHs:

Likelihoods[symbol] = GARCHs[symbol].train_log_likelihood()

Likelihoods = pd.DataFrame.from_dict(Likelihoods, orient= "index")

Likelihoods.columns = ["log(L)"]

Likelihoods = Likelihoods.transpose()

return Likelihoods

def get_garchs():

original_garches = {}

for symbol in DATA:

am = arch_model(1000*train_daily[symbol]["return"], mean='Constant', vol='garch')

res = am.fit(disp="off")

original_garches[symbol] = res

return original_garches

def arch_log_likelihood(arches, scale = 1):

ans = {}

for symbol in arches:

arch_res = arches[symbol]

vol = (arch_res.conditional_volatility/scale)**2

resid = arch_res.std_resid

loglikelihood = -0.5*np.sum(np.log(2*np.pi*vol) + resid**2)

ans[symbol] = loglikelihood

ans = pd.DataFrame.from_dict(ans, orient="index")

ans.columns=["log(L)"]

ans = ans.transpose()

return ans

We fit our reailized Garch model and the classical Garch separately and compare them by the likelihoods. Our realized model achieves better value in AAPL, MSF, TSLA and SP500. The fit for AMZN and FB seems not working.

realizedGarch_log_likelihood()

| AAPL | AMZN | FB | MSFT | TSLA | SP500 | |

|---|---|---|---|---|---|---|

| log(L) | 720.881208 | 702.766017 | 659.948803 | 734.951069 | 555.322595 | 872.821334 |

arch_log_likelihood(get_garchs(), scale = 1000)

| AAPL | AMZN | FB | MSFT | TSLA | SP500 | |

|---|---|---|---|---|---|---|

| log(L) | 714.535985 | 708.639553 | 662.078304 | 734.394404 | 549.42429 | 867.143143 |

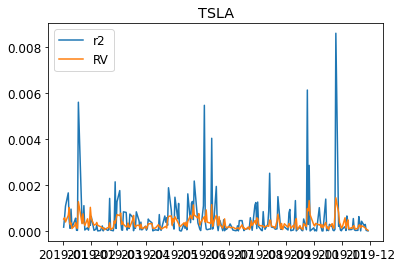

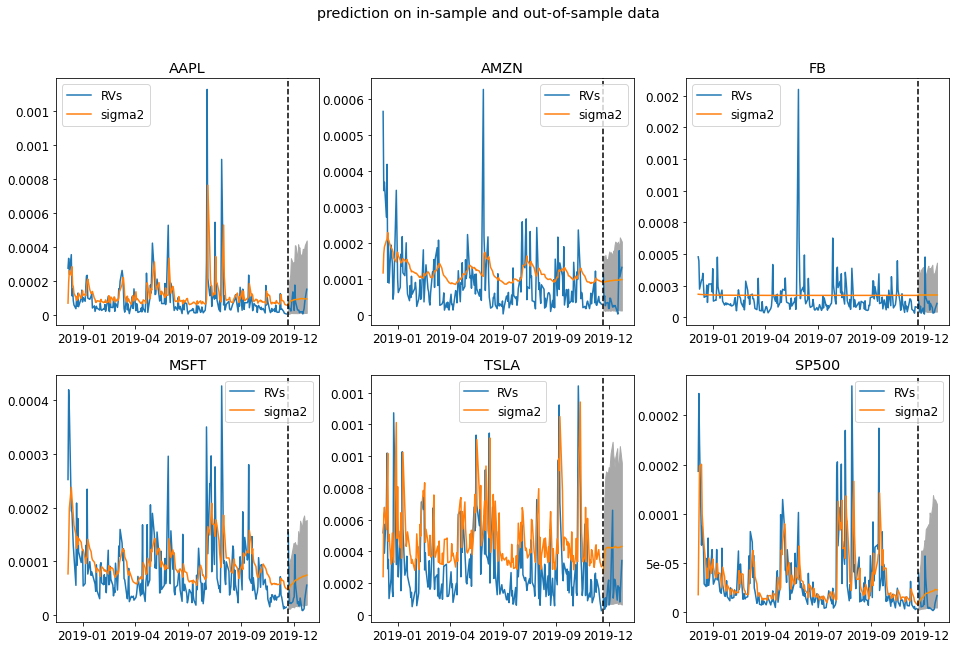

From the below plot its clear why the FB and AMZN do not show higher likelihood. The fitted conditional variance $\sigma^2$ doest follow the realized variance. Especially, the FB model has $\beta = 0$ and does not take into account of realized variance in the model. The AMZN has very small coefficient for $\beta$ and is thus very insensitive to the change of the market (the rise or fall of realized variance).

fig, axs = plt.subplots(2, 3, figsize=(16,10))

for i in range(2):

for j in range(3):

ax = axs[i][j]

symbol = RV_tuning.columns[i*3+j]

GARCHs[symbol].plot(ax= ax)

ax.xaxis.set_major_locator(MaxNLocator(5))

ax.xaxis.set_major_formatter(mdates.DateFormatter("%Y-%m"))

ax.xaxis.set_minor_formatter(mdates.DateFormatter("%Y-%m"))

ax.yaxis.set_major_formatter(FormatStrFormatter('%1.1g'))

ax.title.set_text(symbol)

def plot_z(Garchs):

fig, axs = plt.subplots(nrows=2, ncols=3, figsize=(16,8))

fig.suptitle(r"QQ plot for $z_t$")

plt.subplots_adjust(wspace = 0.6)

axs = axs.reshape(-1)

for j, stock in enumerate(Garchs):

ax1 = axs[j]

ax1.set_title(stock)

qqplot(Garchs[stock].std(), line = "s", ax = ax1)

ax1.set_xlabel("")

plt.savefig("zt.png")

def plot_u(Garchs):

fig, axs = plt.subplots(nrows=2, ncols=3, figsize=(16,8))

fig.suptitle(r"QQ plot for $u_t$")

plt.subplots_adjust(wspace = 0.6)

axs = axs.reshape(-1)

for j, stock in enumerate(Garchs):

ax1 = axs[j]

ax1.set_title(stock)

measure_RV = Garchs[stock].measure_RV()

diff = np.log(measure_RV) - np.log(Garchs[stock].RVs_original[1:])

qqplot(diff, line = "q", ax = ax1)

ax1.set_xlabel("")

plt.savefig("ut.png")

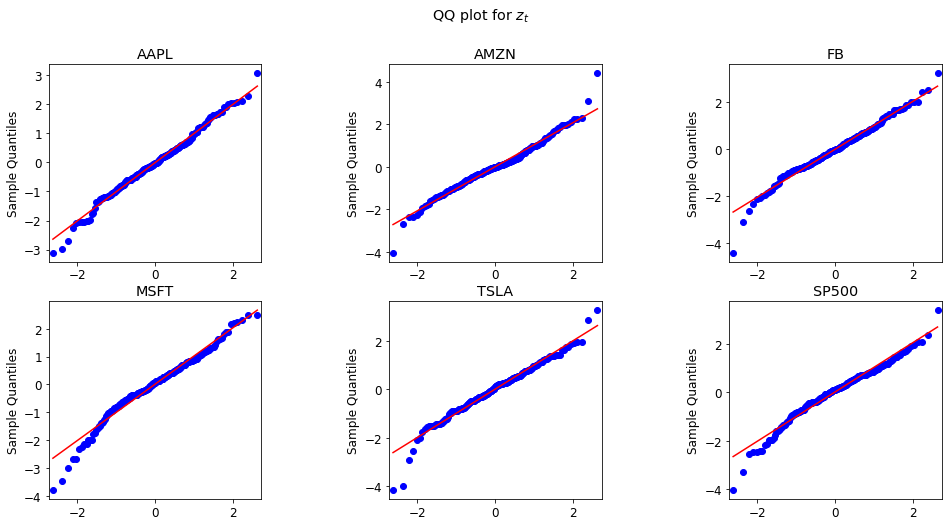

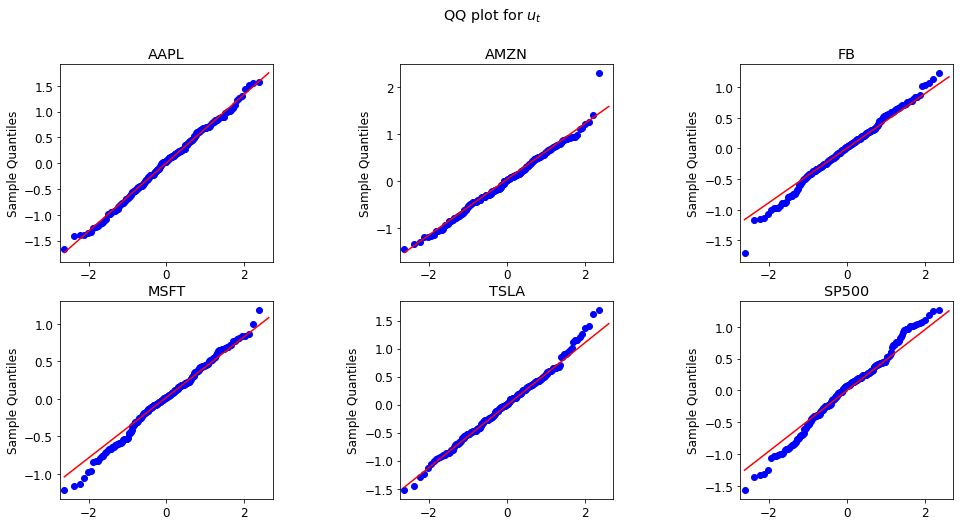

We plot fitted residual for $z_t$ and measurement linear regression residual $u_t$ in qq plot. The plot shows that they almost follow the normal distribution. As a result, the assumption is mildly satisfied.

plot_z(GARCHs)

plot_u(GARCHs)

DCC correlations

We fit the rGARCH-DCC model with the DCC employed to describe the correlation among the shocks $z_t$ among the symbols.

rGarch = RGARCH_DCC(train_daily, garch_scale = 1000)

rGarch.fit(verbose = 0)

rGarch.params()

fit AAPL ...

best L1 = -650.558

fit AMZN ...

best L1 = -668.673

fit FB ...

best L1 = -711.490

fit MSFT ...

best L1 = -636.488

fit TSLA ...

best L1 = -816.116

fit SP500 ...

best L1 = -498.618

iteration: 1 log(L): 73.840 a: 0.38595 b:0.61405

iteration: 2 log(L): 680.975 a: 0.3732 b:0.31926

iteration: 3 log(L): 672.804 a: 0.3509 b:0.58848

iteration: 4 log(L): 515.326 a: 0.31236 b:0.68764

iteration: 5 log(L): 543.880 a: 0.30289 b:0.69711

iteration: 6 log(L): 579.609 a: 0.2883 b:0.7117

iteration: 7 log(L): 572.286 a: 0.29162 b:0.70838

iteration: 8 log(L): 625.487 a: 0.25989 b:0.74011

iteration: 9 log(L): 533.779 a: 0.30642 b:0.69358

iteration: 10 log(L): 649.872 a: 0.19871 b:0.80129

iteration: 11 log(L): 687.172 a: 0.30417 b:0.62254

iteration: 12 log(L): 687.863 a: 0.30861 b:0.59438

iteration: 13 log(L): 687.865 a: 0.30947 b:0.59154

iteration: 14 log(L): 687.865 a: 0.30952 b:0.59176

iteration: 15 log(L): 687.865 a: 0.30948 b:0.59181

iteration: 16 log(L): 687.865 a: 0.30948 b:0.59181

rGarch parameters:

AAPL AMZN FB MSFT TSLA SP500

omega 0.000035 0.000013 0.000012 0.000011 0.000241 0.000003

beta 0.306265 0.804552 0.932296 0.665771 0.000000 0.415299

gamma 0.498232 0.112582 0.000000 0.248973 0.762372 0.502016

mu 0.001039 0.000049 0.000246 0.000175 0.000450 0.000387

xi 0.221838 7.076395 153.648558 2.076153 -1.130535 -0.787398

phi 1.084924 1.846474 18.791195 1.256567 0.931592 0.943701

tau1 -0.101627 -0.092318 -0.105260 -0.072026 -0.026562 -0.174259

tau2 0.244832 0.176118 0.134127 0.156663 0.149789 0.153689

sigmaU 0.650246 0.584097 0.490212 0.444128 0.566098 0.554517

DCC parameters:

a 0.309478

b 0.591807

dtype: float64

def plot_predict(RGARCH, test, n_sample = 1000, low_q = 0.025, high_q = 0.975):

horizon = test.shape[0]

sigma2_pred, RV_pred = RGARCH.predict_horizon(

horizon,

n_sample = n_sample,

low_q = low_q, high_q = high_q)

sigma2_mean = pd.DataFrame(sigma2_pred[1,...])

sigma2_high = pd.DataFrame(RV_pred[2,...])

sigma2_low = pd.DataFrame(RV_pred[0,...])

sigma2_mean.index = test.index

sigma2_high.index = test.index

sigma2_low.index = test.index

fig, axs = plt.subplots(2, 3, figsize=(16,10))

fig.suptitle("prediction on in-sample and out-of-sample data")

axs = axs.reshape(-1)

for j, stock in enumerate(RGARCH.stocks):

test_returns = test[stock]["RV"]

ax = axs[j]

RGARCH.GARCHs[stock].plot(ax=ax)

ax.plot(test_returns, color ='#1f77b4')

ax.plot(sigma2_mean.iloc[:,j], color = "darkorange")

ax.fill_between(sigma2_mean.index, sigma2_low.iloc[:,j],

sigma2_high.iloc[:,j], color = "darkgrey")

ax.axvline(x=test.index[0], color = "k", linestyle = '--')

ax.xaxis.set_major_locator(MaxNLocator(5))

ax.xaxis.set_major_formatter(mdates.DateFormatter("%Y-%m"))

ax.xaxis.set_minor_formatter(mdates.DateFormatter("%Y-%m"))

ax.yaxis.set_major_formatter(FormatStrFormatter('%1.1g'))

ax.title.set_text(stock)

return fig

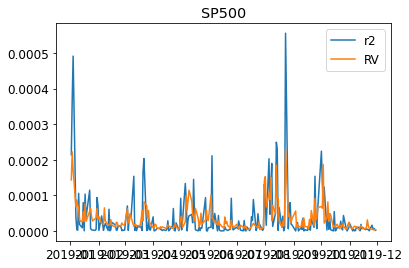

In this plot, we plot the fitted $\sigma^2$ and the predicted $\sigma^2$ in December. The gray area is the $95\%$ confidence interval for the realized variance. The plots shows that the predicted realized variance confidence interval contains the true hidden test data. This indicates a successful forecast.

fig = plot_predict(rGarch, test_daily)

fig.savefig("train_test.png")

We design a function that could use rolling bootstrap to estimate the confidence interval of the estimated parameters.

def rolling_bootstrap(train, n_bootstrap):

length = train.shape[0] - n_bootstrap + 1

GARCH_params = None

DCC_params = None

count = 0

for i in range(n_bootstrap):

garchDCC = RGARCH_DCC(train.iloc[i:i+length,:],

garch_scale = 1000)

garchDCC.fit(verbose = 0)

if GARCH_params is None:

shape = [n_bootstrap] + list(garchDCC.GARCH_PARAMs.shape)

GARCH_params = np.zeros(shape=shape)

if DCC_params is None:

DCC_params = np.zeros(shape = (n_bootstrap, 2))

if garchDCC.DCC_PARAMs["b"] <= 1.0e-5 :

continue

GARCH_params[i,:,:] = garchDCC.GARCH_PARAMs

DCC_params[count,:] = garchDCC.DCC_PARAMs

count +=1

GARCH_params_std = np.std(GARCH_params, axis = 0)

DCC_params_std = np.std(DCC_params[:count,:], axis = 0)

GARCH_params_std = pd.DataFrame(GARCH_params_std)

GARCH_params_std.index = garchDCC.GARCH_PARAMs.index

GARCH_params_std.columns = garchDCC.GARCH_PARAMs.columns

DCC_params_std = pd.Series(DCC_params_std)

DCC_params_std.index = garchDCC.DCC_PARAMs.index

print (count)

return GARCH_params_std, DCC_params_std

rGarch.GARCH_PARAMs

| AAPL | AMZN | FB | MSFT | TSLA | SP500 | |

|---|---|---|---|---|---|---|

| omega | 0.000035 | 0.000013 | 0.000012 | 0.000011 | 0.000241 | 0.000003 |

| beta | 0.306265 | 0.804552 | 0.932296 | 0.665771 | 0.000000 | 0.415299 |

| gamma | 0.498232 | 0.112582 | 0.000000 | 0.248973 | 0.762372 | 0.502016 |

| mu | 0.001039 | 0.000049 | 0.000246 | 0.000175 | 0.000450 | 0.000387 |

| xi | 0.221838 | 7.076395 | 153.648558 | 2.076153 | -1.130535 | -0.787398 |

| phi | 1.084924 | 1.846474 | 18.791195 | 1.256567 | 0.931592 | 0.943701 |

| tau1 | -0.101627 | -0.092318 | -0.105260 | -0.072026 | -0.026562 | -0.174259 |

| tau2 | 0.244832 | 0.176118 | 0.134127 | 0.156663 | 0.149789 | 0.153689 |

| sigmaU | 0.650246 | 0.584097 | 0.490212 | 0.444128 | 0.566098 | 0.554517 |

rGarch.DCC_PARAMs

a 0.309478

b 0.591807

dtype: float64

def getRV_data(data, weights):

indexs = data.columns.get_level_values(0).unique()

returns = np.zeros( (data.shape[0], len(indexs)) )

for i,symbol in enumerate(indexs):

returns[:,i] = data[symbol]["return"]

sigma2 = returns.dot(weights)**2

sigma2 = pd.Series(sigma2)

sigma2.index = data.index

return sigma2

def plot_portfolio_RV(train, test, model, weights, low_q = 0.025,

high_q = 0.975, ax = None):

model_sigma2 = model.get_portfolio_sigma2(weights)

train_sigma2 = getRV_data(train_daily, weights)

test_sigma2 = getRV_data(test_daily, weights)

pred_sigma2 = rGarch.predict_horizon_portfolio(

test_sigma2.shape[0],

weights,

low_q = low_q, high_q = high_q)

pred_sigma2 = pd.DataFrame(pred_sigma2.T)

pred_sigma2.index = test_daily.index

if ax is None:

ax = plt.gca()

ax.plot(train_sigma2, color = "#1f77b4", label = r"$r^2$")

ax.plot(test_sigma2, color = "#1f77b4")

ax.plot(model_sigma2, color = "darkorange", label = r"model $\sigma^2$")

ax.plot(pred_sigma2.iloc[:,1], color = "darkorange")

ax.fill_between(pred_sigma2.index, pred_sigma2.iloc[:,0],

pred_sigma2.iloc[:,2], color = "darkgrey")

ax.axvline(x=test.index[0], color = "k", linestyle = '--')

ax.legend(loc="best")

return

def plot_six_pack(train, test, model, weights = None,

low_q = 0.025, high_q = 0.975):

symbols = train.columns.get_level_values(0).unique()

n_symbols = len(symbols)

if weights is None:

weights = np.random.uniform(size=(6, n_symbols))

weights = weights/np.sum(weights, axis=1)[:,None]

fig, axs = plt.subplots(2, 3, figsize=(16,10))

fig.suptitle(r"portfolio $\sigma^2$ estimation")

print (weights)

print (weights.sum(axis=1))

axs = axs.reshape(-1)

for i in range(6):

ax = axs[i]

plot_portfolio_RV(train, test, model, weights[i,:],

low_q, high_q, ax = ax)

ax.xaxis.set_major_locator(MaxNLocator(5))

ax.xaxis.set_major_formatter(mdates.DateFormatter("%Y-%m"))

ax.xaxis.set_minor_formatter(mdates.DateFormatter("%Y-%m"))

ax.yaxis.set_major_formatter(FormatStrFormatter('%1.1g'))

ax.title.set_text(f"portfolio {i+1:d}")

return fig

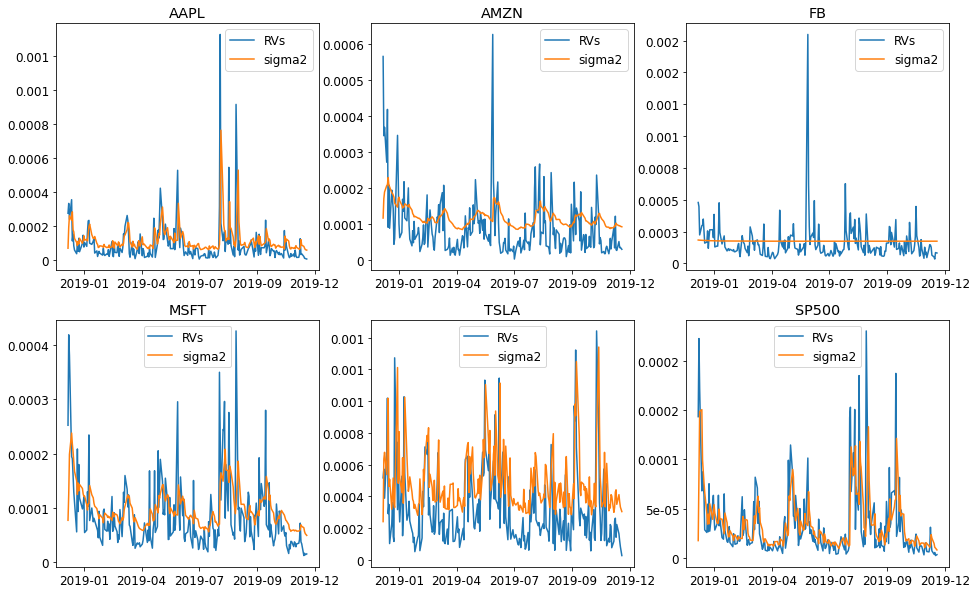

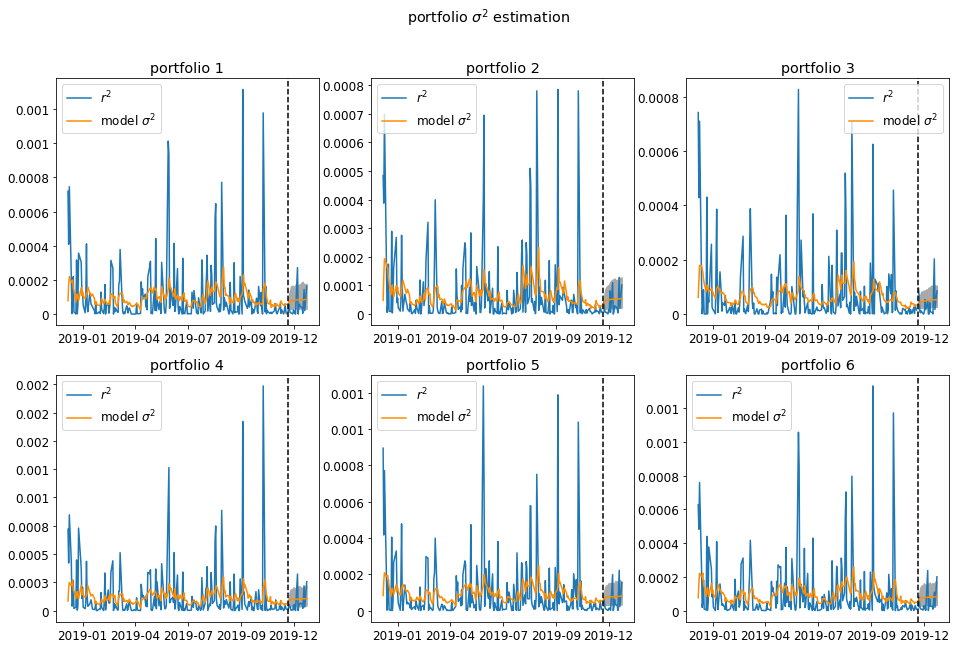

We then construct six random portfolio consisting of the 6 symbols we have. We do this because we want to test whether the correlation matrix is estimated well. The portfolio volatility needs the correlation matrix and individual volatility. Below we plotted the fitted portfolio $\sigma^2$ and the prected $\sigma^2$ in December. The blue line is the portfolio realized return squared.

fig = plot_six_pack(train_daily, test_daily, rGarch)

plt.savefig("six_pack.png")

[[0.16405074 0.17298219 0.19924118 0.0351977 0.247057 0.18147119]

[0.12837752 0.19303799 0.01225164 0.04758079 0.17934214 0.43940992]

[0.10489163 0.25960325 0.0583599 0.26450911 0.0773851 0.23525101]

[0.09721203 0.31495958 0.05358826 0.04046787 0.3348108 0.15896146]

[0.14997454 0.26229132 0.18209948 0.11644926 0.19562806 0.09355733]

[0.0638383 0.15728596 0.12019817 0.25126211 0.2573531 0.15006237]]

[1. 1. 1. 1. 1. 1.]

Leave a comment